HOAhomepage is initiating a nationwide research project on Common Interest Developments (CIDs) and property owners associations, which will engage professionals across various disciplines, ranging from subdivision development to the oversight and management of community associations.

Retail professionals, such as appraisers, attorneys, and RE agents, will also participate in a property exchange, that serves nonresident owner/investors. We are not looking to create a directory or solicit advertisers, we are, however, looking for a limited number of professionals to participate in our research project, by interacting directly with the members of the property owners association we are creating along side the research project. We want to create a longterm relationship with common interest property owners to build our brand generally, but more importantly, we want our professionals to develop relationships with owners in specific communities. We want branding not solicitations, so our professionals need to be educators and advisors, first. HOAhomepage will do the soliciting, by reaching out to current owners and by attracting prospective owners to the property owners association. We will educate, sort, classify and poll all visitors to our site. All of our visitors will fit into one or more “Special Interest Groups” which allows us to determine when and if there is a need for a specific professional.

Structure of the CID archive

- States

- Regions

- HOA Blocks

This project will focus, initially, on the needs of all property owner types; resident and non-resident owners, including the developers who hold unit ownership after turnover of the association vs. the needs and responsibilities of the boards of directors. However, all property owners including the board will participate in governance-related surveys and polls. Boards can initiate their polls or surveys as well. All interactions will be localized rather than national surveys or polls.

You have been invited to this page because you hold a CIRM designation from the CAI. We want risk management to be prominent in our effort to reach property owners. We have designed our regions around the branding needs of your profession. A region is a geographics location within a state. We want you to educate and brand yourself, not solicit RFPs. We consider you a strategic partner in this effort.

The objective is to establish a connection with property owners from their initial purchase (or development) to the sale of their property. We have identified several transactional inefficiencies where we will introduce proptech solutions we have developed. Our entry to individual communities is through the new owners. We have set up platforms for “First time buyers”, “Retiring Seniors” and a property exchange to serve investor owners, where we engage with the principals well in advance of a transaction. Additionally we will solicit participation in individual community networks to the general market using AI driven SEO. These real estate solutions will scale certain processes and provide the revenues needed to sustain the project into the future, but useage will be driven by local professionals.

In order to collect useful data and support services like the property exchange, we need to archive and codify the common interest subdivision market. We have created a structure to actively and systematically collect and organize the data locally.

The data collection challenge

.

.

Welcome. My name is Dick Gordon, I am the founder and CEO of HOAhomepage. HOAhomepage is a research and fintech development company serving common interest home builders since 1999. My experience as a common interest development entrepreur started when I was practicing accounting in the 1970s. Over the last six years we have been conducting surveys related to owner interactions with various professional services. We were looking for transactional inefficiencies related to common interest properties.

Our research also included professions that serve this industry from land development to the governance of community associations. Based on our findings, we are launching a new project with the objective of codifying and archiving all common interest subdivisions and establishing a property owners associations, to maintain a permanent connection with the owners. These owners will provide insight into the individual community. This allows us to provide valuable analysis for developers, prior to securing land or mapped subdivisions. It wil also allow us to connect with and vet professionals who serve either the community, individual owners or both. We have designed several revenu producing applications based on our findings.

We are forming a property owners association, a not for profit membership entity. This entity is where we archive property data and individual owner profiles. The collection of property data and community information will be a collaborative effort between HOAhomepage research and the owners, tenants and, local advisors and researchers, connected to specific subdivisions. To cover the entire US will take years to achieve. However, the process and structure is organized to grow organically.

I am forming executive teams regionally in eight states to form and manage a property exchange for the owners association. The LLC will be a not for profit entity and all net fees collected by the Common Interest Property Owners Association (CIPOA) will be distributed to the principals in the LLC.

The partent entity of the exchange is the Common Interest Property Owners Association (CIPOA) also a not-for-profit LLC, owned in common by HOAhomepage and the Regional executives. You are a prospective regional advisor and possible principle in this LLC. It will receive revenues from subscriptions, transactional adminstrative fees, and residuals from software applications that serve users of our owner to owner property exchange.

There will be approximately 70 regions in the US, led by certain types of professionals, 15 of which will be principals in the LLC. The reason we have chosen these professionals is because they are not typically participants in real estate transactions, and consequently will remain neutral.

The launch of this venture is being self funded by HOAhomepage. Our regional executives will be professionals from the following disciplines.

- Investment/retirement advisors (must be willing to guide and mentor novices)

- Independent Appraisers

- Qualified Intermediaries

- Title Executives

- Trust Attornies

HOAhomepage provides the direct interface with all visitors and screens needs and intentions and introduces them to the advisor who can help them move toward their goals.

Additionally, each region has localized market advisors, who are licensed appraisers. These appraisers develop subdivision profiles and research and collect data in a licensed archive.

All buyers are directed to the region where they reside, even if they plan out of state transactions. It is our intent to engage before buyers enter the market and help them plan acquisitions. Some of these buyers can benefit from professional financial planning as well as 1031 advise or even teenagers planning college housing. From this pool of users, we will educate and guide them through self directed tools, and brand the regional advisors through out. No directories.

The existing data resourses for assessing trends in the common interest segment of the building industry is lacking. The industry is far more diverse than the national estimates suggest. The analysis we intend to provide to the development industry, state and local law makers, resident owners, non-resident owners, (and tenants) and community boards will either confirm or revise current assumptions. Additionally, existing common interest developments (HOA, Condominiums etc) contribute to an annual $92 billion dollar maintenance industry. We intend to particpate in this market by offering analysis, scaled financial services, insurance cooperatives, statutory compliance, mediation and contract negotiation services to community associations. We have set up several platforms that engage with indviduals who are or will conduct a transaction that involves a common interest property. Why?

We are forming and scaling a Niche market

Common Interest subdivisions can take mulitple forms commonly categorized by the classification of individual title. A homeowners association manages the community, but is referred to as a condominium, townhome, zero lot line, etc which basically defines the maintenance and liability of the separate interest (property owner) and the homeowners association (common interest subdivision) In the building industry these are collectively referred to as Common Interest Developments or CIDs. CIDs dominate production housing, nationwide, a trend that will not end for a variety of reasons and motivations.

The total number of individually owned homes in the US is 128.5 million with about 26 million within identifiable common interest subdivisions. The reason we use CIDs to form this market is because it’s easier to categorize the data. But it is a challenge to organize the collection of micro data. For example this 26m housing pool is subcategorized into 350,000 subdivisions. These 350k subdivisions are futher categorized by type (condo, sf, townhome etc), each with common characteristics. Also, certain elements of the neighborhood, maintenance and quality of life are predictable. Production home builders offer another category that will help track specific model type/designs within local markets. Which helps builders entering a new market or developing a new community. All of this information is provided by numerous data analysis companies and is used to create a micro market profiles for builders. We anticipate this process and provide instant market snapshots of micro markets nationwide. We also track subdivision land. The purpose of all of this organizing is to treat a common interest property more like a commodity in sales and exchanges.

We are not in the real estate business, but, facilitating RE transactions offers us the opportunity to develop our membership. Our Owner2Owner exchange is designed to allow out of state acquisitions, by providing consistent and reliable valuations and critical data, before a home comes on the market. It is a commission free exchange, unless an agent is requested by a buyer. We are structed and organized locally, through our research/advisor group, consequently most owner to owner transactions will be, between local property owners and buyers.

The CIPOA is a not for profit entity, which is owned by the founding members. Any revenues remaining annually, after funding operating expenses and reserves, will be distributed to the founding members.

We are forming a network of Investment/retirement Advisors who will help us in formation of the CIPOA and attract First Time buyers, Retiring seniors, investors and developers to our association. We will be marketing through all available channels to individuals 55 and older, and those who are currently renting and would like to purchase their first home. Local building industry associations (BIA) will play a key role in cataloging the future development of the industry.

We want to help inexperienced or first time investors develop long term investment plans, involving in part CI real estate investment. We want to help guide in the formation of family trusts, 401ks, IRAs or other plans and advice on tax strategies, like 1031 exchanges or DSTs. We are not in the business of providing tax advice, so we are passing on these contacts to professionals like yourself. You will form a team of tax advisors and attorneys to provide for this need. There are no referral fees charged by the CIPOA, for first time buyers, retiring seniors or other members of our association.

Investment/retirement planners form CIPOA regions .

- Develop a personal professional profile- This is for individual advisors, not companies. Companies are profiled individually, but cannot be a CIPOA founder.

- Advisors develop a target market (region) and recruit appraisers to research and develop profiles on the included subdivisions. No other advisors will be branded to this market.

Before we launch the exchange we need to put in place the professionals who will make the exchange function. This starts with our advisor teams.

The advisor team:

- Subdivision researcher advisor Transaction Block owner- Must have at least an appraisal license- this person is the primary contact for current property owners and feeds referrals to the team of advisors and RE support professionals.

- Qualified Intermediary– 1031 exchange advisor

- Investment advisor–

- Retirement advisor/planner

The property exchange is all about advance planning. We want our members to use the exchange and the professional advise offered to prepare for and carryout a successful transaction.

Our objective is to catalog all properties related to common interest developments. This data allows us to profile individual subdivisions, which allows investors to plan future acquisitions by tagging subdivisions which match their criteria. We have developed an owner to owner property exchange where we support direct negotiations. However, a significant portion of property purchases are initiated by first time buyers and retiring seniors, and for these groups we want to attract them to the Common Interest Property Owners Association (CIPOA).

Cataloging the entire industry will take years to achieve, consequently we are focusing building local markets first, which are added to the exchange.

We are setting up teams of advisors to serve individual property owners and two prospective owners, first time common interest buyers and retiring seniors on a local level. . Our initial target audience is the non resident owners. 90% of these owners, are investors who own less than 10 individual properties. Most of these investors got their start investing in common interest properties, and a significant portion turned their residence into their first rental property. We want to introduce these investors to the tax strategies and tools used by more sophisticated investors. Outside of current investors, we see first time buyers as well as retiring seniors enter the CI market and we intend to help them plan this initial investment and beyond.

We are investing in processes and data retrieval to improve the reliability, and efficiency in producing accurate valuations and preliminary reports.

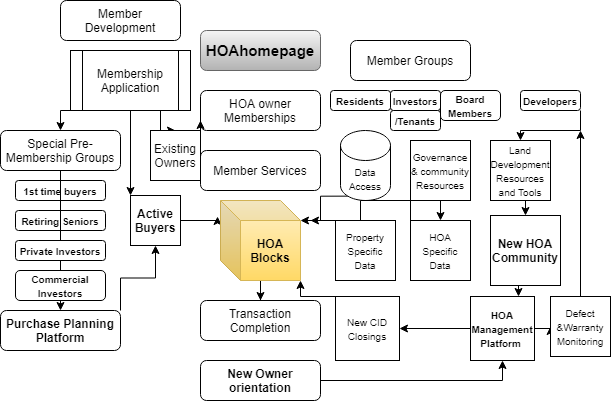

The CIPOA provides our appraisers with the tools to create exclusive markets (HOA Blocks) within our exchange to avoid duplicating research and moderating the messaging to the owners. Below is the flowchart around the HOA Block platform

It is our intent to engage with investors early in their acquisition planning and provide advisors to help them maximize the return on their portfolio.

Common interest developments consists (CID) of any real estate subdivided into separate interests and governed by covenants, conditions and restrictions (Cc&rs). Our member property owners span from pre-subdivided land developers, course construction builders to the retail property owner.

The Common Interest Property Owners Association (CIPOA), a not for profit, is being formed to cover the entire vertical life of this industry. We are endeavoring to catalog all of the 350, 000 US residential CIDs that exist today, as well as a catalog of subdivision land, and course of construction developments. Each of these 350k communities have distinctive characteristics that allow us to group all 26 million dwelling units in the industry. These groupings is the basis of our owner to owner exchange. Our exchange platform is designed for remote acquisitions.

Our objective for the national market is the formation of scaled solutions like insurance pools for certain policy types common to most CIDs. Facilitate the formation of Master Associations for scaling localized needs. Predicting home component obsolescence, based on development data.

Membership development

Our first member platform will be an Owner to Owner exchange. This offers an investors to acquire properties directly from another owner. Any owner can elect to have an agent represent them, but it is not required. The only part the CIPOA plays in the exchange is transaction facilitation. Professional representation is left up to the owners. We set standards for valuations applied nationally.